I was at a social event recently. A woman attending that event, after learning that I was a divorce attorney, came up to me. She told me that her ex-husband had just filed court papers seeking to modify or terminate her alimony payments. With indignation in her voice she explained that “He can’t do that because I have permanent alimony!” It was obvious that this person had taken the word “permanent” literally, and believed that her alimony rights were forever immutable. She seemed genuinely shocked when I explained, without getting into the details of her case, that even “permanent” alimony may be modified or terminated upon a showing of a substantial change in circumstances. Continue reading ›

Articles Posted in Alimony

Social Security Retirement Benefits Post-Divorce

There are some points where federal law intersects with or affects the economic consequences of pending or finalized divorces. Recently one of those point of intersection was the topic  of conversation of a prospective client. Her concern I am sure are shared by many. The question dealt with Social Security and how one computes the 10 year requirement for derivative benefits. Continue reading ›

of conversation of a prospective client. Her concern I am sure are shared by many. The question dealt with Social Security and how one computes the 10 year requirement for derivative benefits. Continue reading ›

Tax Considerations in Divorce

I understand why you might not want to read this but . . . tax season is upon us. While I am an attorney specializing in family law, I frequently come into contact with other areas of law, such as  criminal law, school law, health law, real estate law, elder law, bankruptcy law, and so on. While I am not a tax attorney, tax considerations do come into play in family law, especially divorces, sometimes by circumstance and sometimes by necessity. Please note that I am not an accountant, and your divorce attorney is probably also not an accountant. I do not intend this blog to be legal or accounting advice. If you have any questions about your tax obligations you should definitely consult an accountant. Continue reading ›

criminal law, school law, health law, real estate law, elder law, bankruptcy law, and so on. While I am not a tax attorney, tax considerations do come into play in family law, especially divorces, sometimes by circumstance and sometimes by necessity. Please note that I am not an accountant, and your divorce attorney is probably also not an accountant. I do not intend this blog to be legal or accounting advice. If you have any questions about your tax obligations you should definitely consult an accountant. Continue reading ›

Modifying Alimony Under the 2014 Amendments to New Jersey’s Alimony Statute When the Obligor Spouse’s Income Reduces

In Mills v. Mills, 447 N.J. Super. 79 (Ch. Div. 2016), the family court was confronted with the issue of whether the defendant (payor spouse) should receive a reduction in his alimony obligation upon the loss of long-term employment and his subsequent hire at a new job – at a significantly lower salary. Continue reading ›

upon the loss of long-term employment and his subsequent hire at a new job – at a significantly lower salary. Continue reading ›

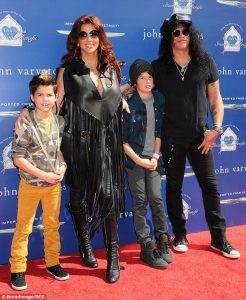

War of the Roses: A Look at Rock Star’s Claim That He Was Never Married to His Spouse of 15 Years

I was recently perusing a periodical and came across a story about a celebrity musician who was claiming he was never married to his wife of 15 years because of a known snafu in her earlier divorce paperwork. The headline stated “Slash claims he was never married to wife of 15 years”. (http://www.metro.us/entertainment/slash-claims-he-was-never-married-to-wife-of-15-years/zsJpjE—wsgif5AIi7dW6/). For those of you who don’t know, Slash, who’s legal name Saul Hudson (which better calls to mind the fictional character Saul Goodman of “Breaking Bad” and “Better Call Saul”), is the prolific lead guitarist of the recently reformed rock group Guns N’ Roses. Continue reading ›

I was recently perusing a periodical and came across a story about a celebrity musician who was claiming he was never married to his wife of 15 years because of a known snafu in her earlier divorce paperwork. The headline stated “Slash claims he was never married to wife of 15 years”. (http://www.metro.us/entertainment/slash-claims-he-was-never-married-to-wife-of-15-years/zsJpjE—wsgif5AIi7dW6/). For those of you who don’t know, Slash, who’s legal name Saul Hudson (which better calls to mind the fictional character Saul Goodman of “Breaking Bad” and “Better Call Saul”), is the prolific lead guitarist of the recently reformed rock group Guns N’ Roses. Continue reading ›

New Jersey Appellate Division Addresses Consideration of a Savings Component When Awarding Alimony

In the preface to Benjamin Franklin’s famous 1758 almanac he proclaimed: “A penny saved is a penny got.” In the parlance of our times, the quote has been more commonly used to stand for “a penny saved is a penny earned.” Whether or not Benjamin Franklin, a learned economist, meant that a penny saved, as opposed to reinvested, was in fact a penny earned is up for debate. On September 12, 2016, in the case of Lombardi-v-Lombardi, the New Jersey Appellate Division addressed the issue of how alimony should be calculated in a divorce case when the parties during the marriage historically saved money. Continue reading ›

New Jersey Family Court Interprets Standard for Prospective Retirement in Alimony Cases

In September 2014, the New Jersey Legislature amended this State’s statute on alimony. Among the changes that the new alimony statute contains was a provision related to retirement. The addition that the Legislature made to the alimony statute to include a provision for alimony is lengthy. N.J.S.A. 2A:34-23(j) now provides that alimony may be modified or terminated “upon the prospective or actual retirement of the obligor.” Continue reading ›

changes that the new alimony statute contains was a provision related to retirement. The addition that the Legislature made to the alimony statute to include a provision for alimony is lengthy. N.J.S.A. 2A:34-23(j) now provides that alimony may be modified or terminated “upon the prospective or actual retirement of the obligor.” Continue reading ›

What is the Impact of a Couple Living Beyond Their Means During the Marriage Upon an Alimony Award?

It is a well settled proposition in New Jersey that the “goal of a proper alimony award is to assist the supported spouse in achieving a lifestyle that is reasonably comparable to the one enjoyed

while living with the supporting spouse during the marriage.” Weishaus v. Weishaus, 180 N.J. 131, 140, 849 A.2d 171, 177 (2004); see also Lepis v. Lepis, 83 N.J. 139 (1980); Crews v. Crews, 164 N.J. 11 (2000).

MATRIMONIAL P.I.: Practical Considerations in the Use of Private Investigators in Matrimonial Matters

When you mention Private Investigators in the context of a matrimonial dispute, most people think of what is portrayed in movies or in television of a gumshoe Detective tailing a car or hiding in the bushes, trying to get the goods on a suspected cheating spouse. While hiring a private investigator to determine whether a spouse may be engaged in an adulterous relationship remains a common reason to do so, there are a multitude of other reasons why the use of a private investigator can be an important tool for the client as well as the attorney in the preparation of a matrimonial case. This blog post will discu ss some of these circumstances, as well as some practical and legal considerations affecting the use of private investigators. Continue reading ›

ss some of these circumstances, as well as some practical and legal considerations affecting the use of private investigators. Continue reading ›

New Jersey Supreme Court Addresses Discretion of Judges When Interpreting Agreements for Termination of Alimony Due To Cohabitation

We have written previously about issues of cohabitation and it’s impact on the right and obligation to receive and pay alimony. We have also written about the courts’ attitudes towards the  enforcement of Property Settlement Agreements. On May 3, 2016 the Supreme Court of New Jersey in the matter of Quinn -v- Quinn, — NJ — (2016) [(A-5-14) (074411)], addressed the issue of enforcing terms of a Property Settlement Agreement involving the effect of cohabitation on provisions dealing with alimony in the matter. In this matter the parties, who were married in 1983, entered into a Property Settlement Agreement in 2006 providing that upon the Wife’s cohabitation, per case or statutory law, her alimony would terminate. Continue reading ›

enforcement of Property Settlement Agreements. On May 3, 2016 the Supreme Court of New Jersey in the matter of Quinn -v- Quinn, — NJ — (2016) [(A-5-14) (074411)], addressed the issue of enforcing terms of a Property Settlement Agreement involving the effect of cohabitation on provisions dealing with alimony in the matter. In this matter the parties, who were married in 1983, entered into a Property Settlement Agreement in 2006 providing that upon the Wife’s cohabitation, per case or statutory law, her alimony would terminate. Continue reading ›

New Jersey Divorce and Family Lawyer Blog

New Jersey Divorce and Family Lawyer Blog